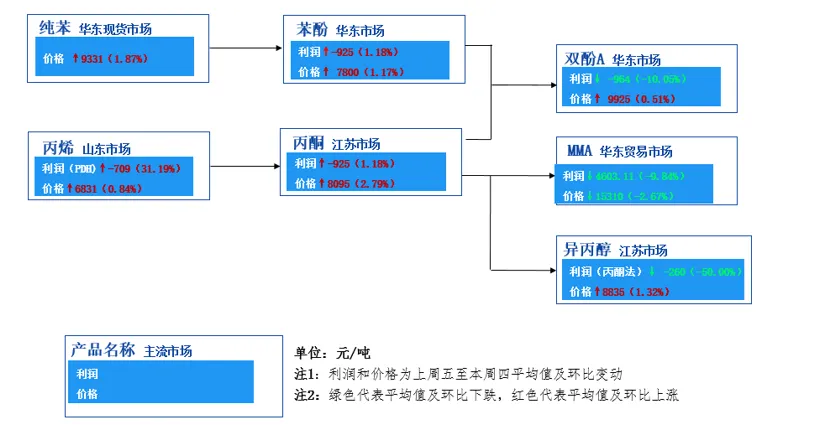

1,Tag nrho tus nqi nce hauv phenolic ketone kev lag luam saw

Lub lim tiam dhau los, tus nqi xa tawm ntawm phenolic ketone kev lag luam saw tau du, thiab cov khoom lag luam feem ntau tau pom qhov nce siab. Ntawm lawv, qhov nce hauv acetone yog qhov tseem ceeb, nce mus txog 2.79%. Qhov no feem ntau yog vim qhov txo qis hauv cov khoom lag luam propylene thiab cov nqi them nyiaj muaj zog, ua rau muaj kev nce hauv kev lag luam kev sib tham. Kev khiav hauj lwm load ntawm domestic acetone factories yog txwv, thiab cov khoom yog qhov tseem ceeb rau downstream mov. Qhov chaw nruj ncig hauv khw txuas ntxiv ua rau tus nqi nce.

2,Kev ntim khoom nruj thiab tus nqi hloov pauv hauv MMA kev ua lag luam

Tsis zoo li lwm cov khoom lag luam hauv kev lag luam, tus nqi nruab nrab ntawm MMA txuas ntxiv poob rau lub lim tiam dhau los, tab sis tus nqi txhua hnub tau pom tias thawj zaug poob qis tom qab nce. Qhov no yog vim tsis tau npaj tseg txij nkawm ntawm qee cov khoom siv, ua rau txo qis hauv MMA kev khiav haujlwm load tus nqi thiab cov khoom siv nruj ntawm cov khoom muag hauv khw. Los ntawm kev ntxiv cov nqi txhawb nqa, cov nqi lag luam tau nce. Qhov tshwm sim no qhia tau hais tias txawm hais tias MMA tus nqi cuam tshuam los ntawm cov khoom tsis txaus nyob rau lub sijhawm luv luv, cov nqi tseem ceeb tseem txhawb nqa cov nqi lag luam.

3, Tus nqi kis tau tus mob Analysis ntawm Ntshiab Benzene Phenol Bisphenol A Chain

Nyob rau hauv cov ntshiab benzene phenol bisphenol A saw, tus nqi kis tau tus mob

cov nyhuv tseem zoo. Txawm hais tias cov ntshiab benzene ntsib kev xav tsis zoo ntawm kev tsim khoom ntau ntxiv hauv Saudi Arabia, cov khoom siv tsawg thiab kev tuaj txog tom ntej ntawm qhov chaw nres nkoj tseem ceeb hauv Suav teb sab hnub tuaj tau ua rau cov khoom lag luam nruj thiab nce nqi. Tus nqi inversion ntawm phenol thiab upstream ntshiab benzene tau ntaus tus tshiab qis xyoo no, nrog rau cov nqi zog txhawb zog. Qhov chaw tsis txaus ntawm bisphenol A, ua ke nrog cov nqi siab, cov ntaub ntawv txhawb nqa rau cov nqi los ntawm ob qho tib si tus nqi thiab cov khoom siv. Txawm li cas los xij, tus nqi qis qis qis dua qhov kev loj hlob ntawm cov khoom siv raw, qhia tias tus nqi xa mus rau cov dej ntws qis yog ntsib qee yam teeb meem.

3,Tag nrho profitability ntawm phenolic ketone kev lag luam saw

Txawm hais tias tag nrho cov nqi ntawm phenolic ketone kev lag luam saw tau nce, qhov nyiaj tau los tag nrho cov teeb meem tseem tsis zoo. Qhov theoretical poob ntawm phenol ketone co ntau lawm yog 925 yuan / ton, tab sis qhov loj ntawm qhov poob tau txo qis piv rau lub lim tiam dhau los. Qhov no feem ntau yog vim qhov nce ntawm cov nqi ntawm phenol thiab acetone, thiab qhov loj tag nrho nce piv rau cov khoom siv raw ntawm cov ntshiab benzene thiab propylene, uas ua rau cov nyiaj tau los me ntsis. Txawm li cas los xij, cov khoom lag luam qis xws li bisphenol A tau ua tsis zoo ntawm cov txiaj ntsig tau zoo, nrog rau kev poob ntawm 964 yuan / ton, nce qhov loj ntawm qhov poob piv rau lub lim tiam dhau los. Yog li ntawd, nws yog ib qho tsim nyog yuav tsum tau ua tib zoo saib seb puas muaj cov phiaj xwm txo qis kev tsim khoom thiab kaw cov phenol ketone thiab bisphenol A units nyob rau theem tom ntej.

4,Kev sib piv ntawm cov txiaj ntsig ntawm acetone hydrogenation method isopropanol thiab MMA

Hauv cov khoom lag luam qis ntawm acetone, cov txiaj ntsig ntawm acetone hydrogenation isopropanol tau poob qis, nrog qhov nruab nrab theoretical tag nrho cov nyiaj tau los ntawm -260 yuan / tuj lub lim tiam dhau los, ib hlis ntawm lub hli poob ntawm 50.00%. Qhov no feem ntau yog vim tus nqi siab ntawm cov acetone nyoos thiab qhov nce me me hauv cov nqi isopropanol qis. Hauv qhov sib piv, txawm hais tias tus nqi thiab cov nyiaj tau los ntawm MMA tau poob qis, nws tseem muaj zog muaj txiaj ntsig zoo. Lub lim tiam dhau los, kev lag luam nruab nrab qhov kev xav tau tag nrho cov txiaj ntsig yog 4603.11 yuan / ton, uas yog cov khoom muaj txiaj ntsig zoo tshaj plaws hauv phenolic ketone kev lag luam saw.

Post lub sij hawm: Jun-11-2024